Infinite Banking:

The Key to Financial Control

What is Infinite Banking?

Infinite Banking is a financial strategy where you fund a permanent life insurance policy to access its cash value for borrowing. Instead of traditional bank financing, you use your policy as a source of funds. It offers benefits like easy access to money, flexible loan terms, potential tax-free retirement income, and legacy protection.

Capital Control empowers families to take control of their finances through the Infinite Banking strategy. Whether you're looking to secure your legacy, generate passive income, or achieve financial independence, our tailored solutions can help you reach your goals.

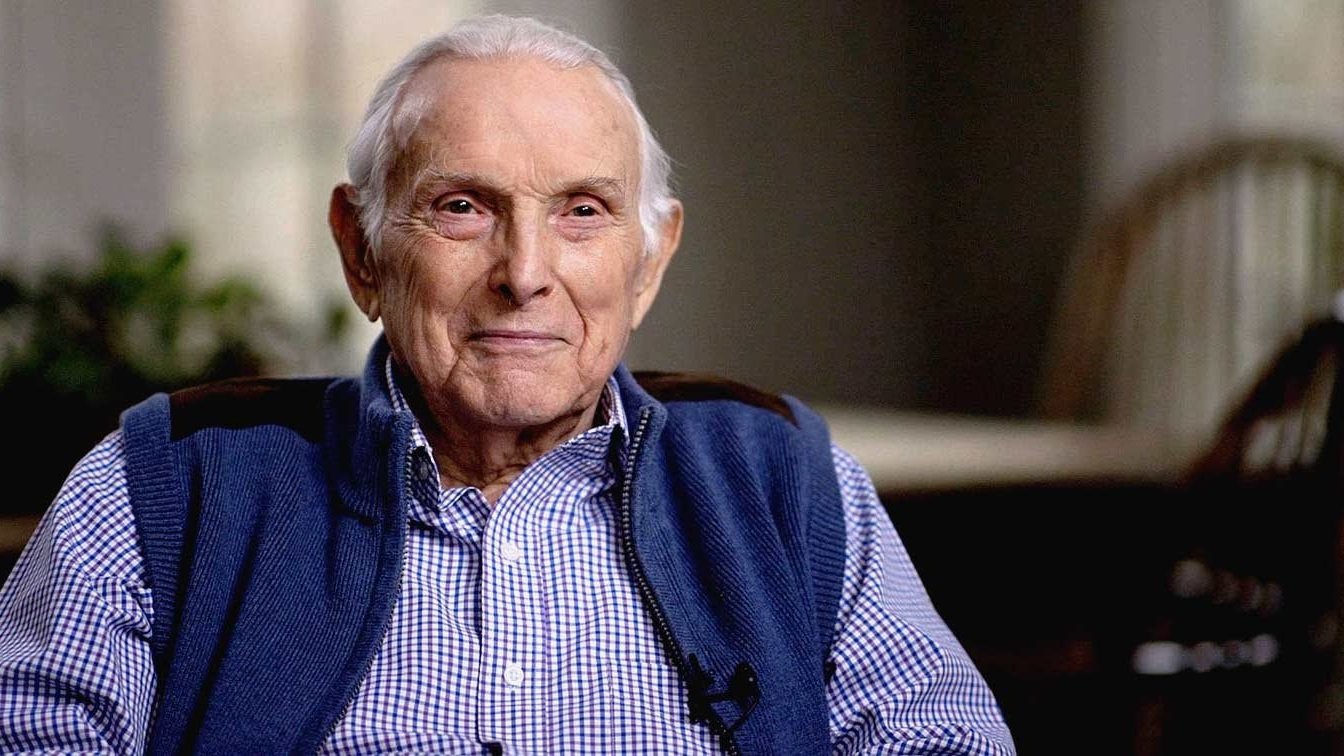

R. Nelson Nash, the Creator of the Infinite Banking Concept

“The whole idea is to recapture the interest that one is paying to banks and finance companies for the major items that we need during a lifetime...The problem is that all these items are financed by other banking organizations.”

Hypothetical $100k Salary

Why You Should Start Infinite Banking

Without Infinite Banking

Rapidly Losing Money to Inflation

35% of Your Income Goes Towards Debt

Your Money is Trapped in 401k/IRAs

Afraid You’ll Outlive Your Money

With Infinite Banking

Maximize Your Money Potential

Payoff Debt Faster. Recapture Interest.

Access Your Money with Total Flexibility

Secure and Tax-Free Retirement & Legacy

How Does Infinite Banking Work?

Step 1: Design Your Infinite Banking Policy

At Capital Control, we begin by helping you design a whole life insurance policy tailored to your financial goals. We work closely with you to understand your unique requirements and craft a policy that maximizes benefits while minimizing fees. Unlike traditional life insurance policies, Infinite Banking requires careful planning and execution to ensure its effectiveness as a wealth-building tool.

Step 3: Borrow from Your Policy

With a substantial cash value built up in your Infinite Banking policy, you have the flexibility to borrow from yourself whenever the need arises. Unlike traditional loans, borrowing from your policy doesn't disrupt the compounding interest growth. This liquidity allows you to access your wealth without penalties or restrictions, providing you with financial freedom and peace of mind.

Step 2: Accumulate Wealth through Cash Value Growth

Once your Infinite Banking policy is established, you start accumulating wealth by growing its cash value. This is achieved through a combination of compounding interest and your regular premium contributions. Over time, the cash value of your policy grows significantly, providing you with a substantial asset that can be accessed at any time.

Step 4: Never Interrupt the Compounding

As you borrow from your Infinite Banking policy, it's important to repay yourself to maintain the integrity of the system. When you repay the borrowed amount, the excess interest paid can purchase additional insurance, further enhancing its cash value and wealth-building potential. Unlike traditional bank loans where the interest goes to the lender, your own banking system leverages uninterrupted compound interest.